Mitigate business risk and financial crime with seamless access to critical information.

Accelerate your performance with plug-and-play services and developer-friendly integrations to collect, verify and monitor company and person data.

Breakfast seminar september 25th - Stockholm

Risk classification – a necessary requirement for compliance or a valuable tool?

On Wednesday, September 25th, you are welcome to attend a breakfast seminar where Amin Bell from Harvest Advokatbyrå will go through the regulatory requirements, and Roaring will explain how data-driven analysis can streamline and automate parts of the risk classification process.

Amin Bell

Harvest Advokatbyrå

Pontus Holmberg Roaring

Choose your way to plug and play

We offer services that effortlessly integrate with your workflows.

Integrate and automate

Choose from more than 60 APIs and monitoring services filled with company and person data.

Get started right away

Search, verify and monitor company and person data through our web platform, or in your Salesforce CRM.

Introducing

Automate your risk evaluation with our new API

We are proud to introduce a groundbreaking service that can automate your risk analysis of business partners, based on a list of recommended indicators from the Swedish Economic Crime Authority. The solution is flexible and adaptable, allowing you to define your own risk parameters for instant analysis.

Streamline your business processes

Use high-quality information to build smart, cost-efficient and scalable processes.

Smooth digital customer journeys

Provide awesome customer experiences and improve business performance by digitising, automating and personalising your:

B2B and B2C customer onboarding

KYC/AML processes

Power of attorney forms

Agreements and contracts

Checkout solutions

AML, KYC and business risk

Reduce manual work and mitigate risk through AML automation. Collect, verify and monitor crucial business information with ease.

PEP and sanctions screening

Beneficial owners and board members

Company group and owner structure information

Bankruptcies and fraudulent behavior

Key financial figures

Monitoring and quality assurance

Your decisions are only as good as your information. That’s why customers use our monitoring services for:

Updating CRM, ERP and other systems

Cleansing outdated information

Identifying new prospects

Ensuring regulatory compliance over time

Ongoing due diligence (ODD)

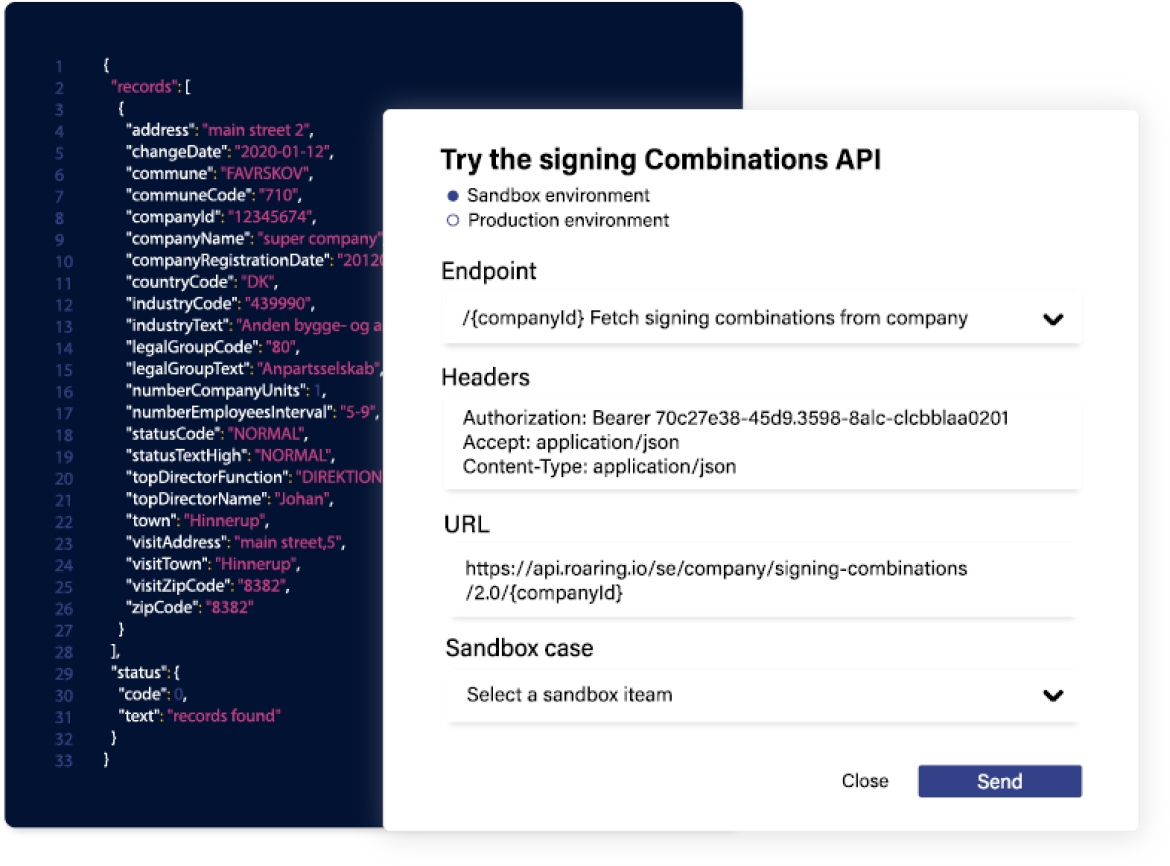

Designed for developers

Developer experience is at the center of everything we do at Roaring. All of our APIs and webhooks are built on the same technical solution regardless of market or service. Meaning shorter time to market, reduced costs for development and happier developers.

Experience it for yourself in our free sandbox environment, or check out our prebuilt partner integrations.

-

"Our prospects can now sign up and become customers, 100% digitally without any physical forms or snail mail."

Carl Lönndahl, Nordnet

-

"We can now collect all the information we require behind the scenes, enabling controls and risk analysis based on real-time customer data."

Amalia Lundin, PE Accounting

-

"Going from a manual process into full automation using data has improved the customer experience significantly."

Jenny Sjövall, SPP

Explore our information

Ready to get in touch?

Learn how Roaring can make your work-life a lot easier.