Qred Bank leads the way in small business financing with ultra-fast loan applications

Qred is one of Sweden's fastest-growing fintechs and Europe’s newest bank. Their partnership with Roaring enhances a fully automated customer onboarding and their proprietary credit scoring system. The collaboration ensures a seamless and compliant loan application process, setting Qred apart in the realm of small business financing.

Qred offers easy and flexible financing for small businesses. The company was founded in Sweden in 2015 and has since then expanded into six new markets. Qred is one of Sweden’s fastest growing fintech companies according to Financial Times, and their recently obtained banking licence allows them to expand their operations to power even more small business owners throughout the EU.

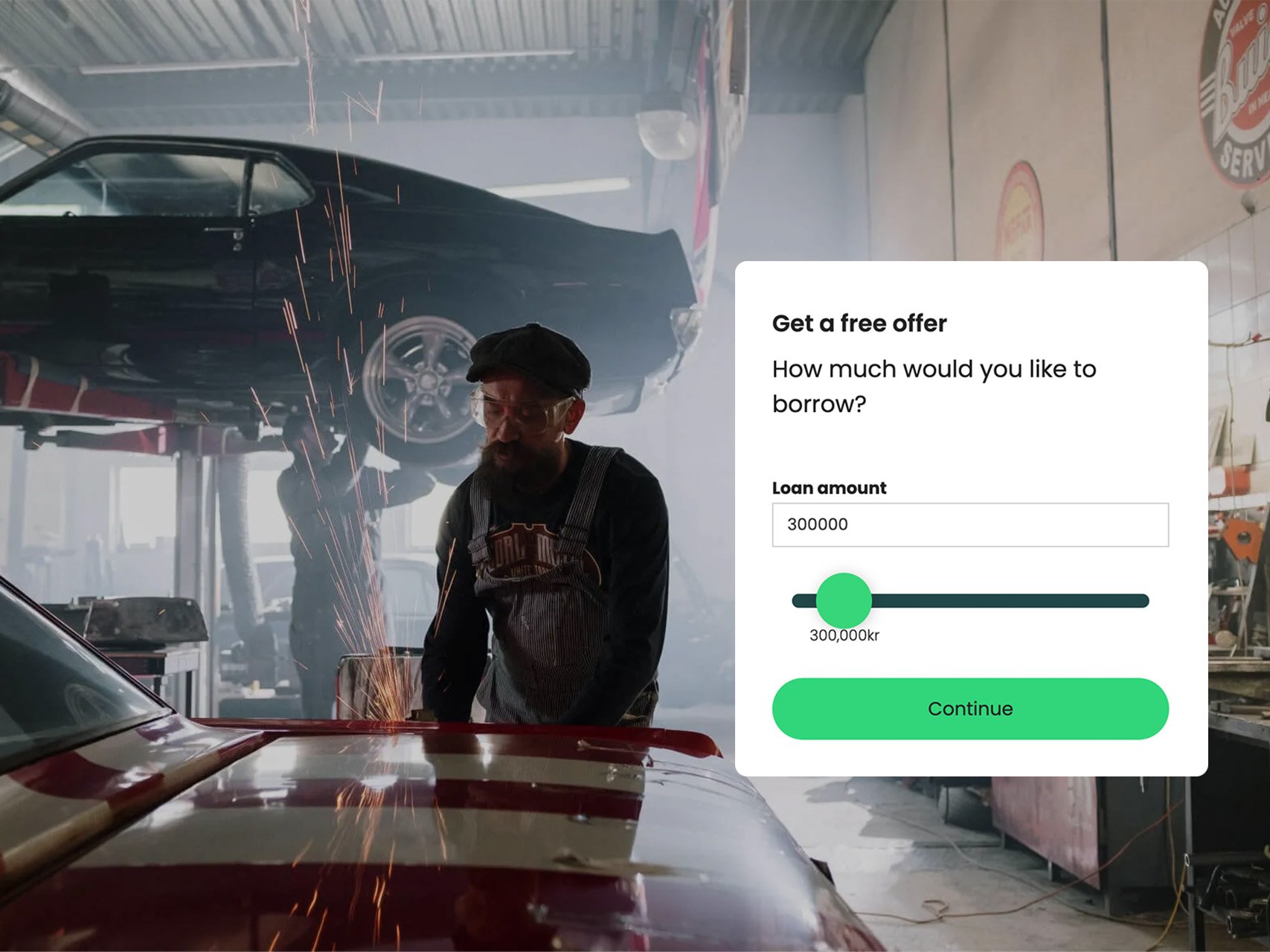

Business loans form the cornerstone of the product range. A fully automated, proprietary credit score system powered with data from Roaring enables a fast and smooth loan application process, which constitutes a significant competitive advantage for Qred.

“It’s much faster to secure a loan with us than with a traditional bank, but the assessment process is equally rigorous. Our partnership with Roaring is one of the prerequisites that makes this possible.”

Qred has transitioned from gathering data from several different sources to using Roaring as a one-stop-shop. The information collected is primarily for compliance purposes, which then goes hand in hand with the credit decision.

The data collection occurs in real-time behind the scenes and only needs to be verified by the customer. The automation contributes to keeping costs down for Qred and creates a smooth customer journey.

– We care a lot about the customers' experience, and we understand their needs. Sometimes financing needs to be arranged quickly, whether it's for the repair of a truck or the purchase of extra pizza boxes ahead of New Year's. Our record is ten minutes from application to disbursed loan, says Molly Wahlström, Customer Operations Manager at Qred.

Qred has also integrated Roaring's data monitoring services to ensure they have updated and accurate information about existing customers.

– We have a large recurring customer base that knows they can quickly and easily contact us when new needs arise. Through monitoring, we keep track of potential risk changes throughout the customer's lifecycle, says Molly Wahlström